The Digital-First Movement

By now, we’re all familiar with the digital trends that have taken over the financial services industry in recent years. Fewer people are visiting branches, more are conducting transactions on their phones and computers, and some have even left their traditional financial institution for a neo-bank, or digital-only bank. With the combined threat of neo-banks and embedded banking, financial institutions will need to think on their feet in the coming years.

Things that used to be accomplished inside a branch will be expected to occur quickly and conveniently using digital means. Having these capabilities could be a financial institutions’ best defense against neo-banks and embedded banking. But it’s not only convenience and brand loyalty that are gained by investing in digital services.

Taking financial services outside the branch and leveraging them through digital channels can also drive revenue-generating services. Let’s look at some of the most popular and reliable ways to drive revenue through digital services.

Account Opening

Opening an account is, in many ways, a consumer’s first impression of their financial institution. It gives them a read on what it will be like to interact with the institution moving forward. And unfortunately, it’s something many financial institutions struggle with. Writer and speaker Brett King summed it up by saying, “Twenty-five years into the commercial internet and banks still haven’t adapted to the most basic element of online capability, namely onboarding a customer.”

Because digital account openings are often seen as arduous processes, the abandonment rate for customers opening accounts online is notoriously high. Forbes quoted Javelin research in 2019, saying that only 8% of account openings were completed start-to-finish on a mobile device. The Financial Brand noted that “while the number of organizations offering digital account opening continues to increase, the ability to complete an account opening continues to be extremely slow. In fact, many consumers will notice that the digital process could actually be slower than an account opening in a branch.”

Without the proper digital solution, many financial institutions could be turning away large volumes of potential customers—missing out on future revenue by failing to make a positive first impression. But with the right Digital Communications Platform, consumers can quickly open accounts, sign and exchange documents, and even fund the account in only a few minutes—and from the comfort of their home.

Lending

Like account openings, loan applications have a reputation for being somewhat burdensome to complete online. Many loan applications can only be partially completed online—requiring the applicant to visit a branch at some point in the process.

The real problem with this friction in the loan application process is that it’s one of the things increasing the divide between traditional financial institutions and the booming new trend of embedded banking. As other products and services are moving into the increasingly digitized market, financial products are being rolled into other purchases and transactions. Embedded banking and Banking as a Service (BaaS) are gaining popularity all over the world, and are projected to cause quite a bit of turmoil for the financial services industry in the coming years.

Consumer attitudes are shifting and convenience is taking center stage. Auto buyers no longer want to visit a branch for an auto loan if they can get a loan directly from the auto manufacturer. “Embedded finance is growing because it gives consumers the all-in-one experience,” wrote The Financial Brand.

But with a Digital Communications Platform, financial institutions can also capitalize on providing a more convenient experience. The whole lending process, from application to closing, can be completed digitally. Not only does this make things easier and more convenient for the consumer, but it also contributes to a greater volume of loans being closed, and many financial institutions report growth to their market value after implementing an effective digital lending process.

Even higher value loans and mortgages that require a notarization to close can be completed with a Remote Online Notary solution, preventing the need for in-person meetings to complete the process.

If your financial institution could benefit from a Digital Communications Platform capable of leveraging loans and account openings outside the branch, we invite you to schedule some time to speak with one of our experts here!

For years, financial institutions have physically modernized their branch environments to direct customers out of transaction teller lines and into new self-service channels like ATMs and banking apps. The shift was designed to allow branch employees to capture and service revenue-producing activities like loans, investments, and business accounts. Some banks and credit unions executed this revenue-focused branch strategy even more efficiently by connecting customers via video to centrally located lending and other product knowledge experts.

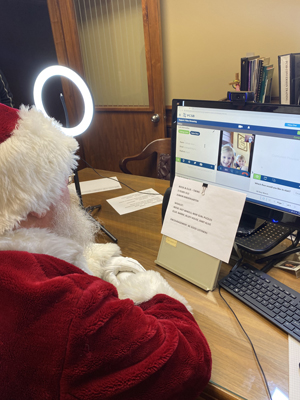

For years, financial institutions have physically modernized their branch environments to direct customers out of transaction teller lines and into new self-service channels like ATMs and banking apps. The shift was designed to allow branch employees to capture and service revenue-producing activities like loans, investments, and business accounts. Some banks and credit unions executed this revenue-focused branch strategy even more efficiently by connecting customers via video to centrally located lending and other product knowledge experts. For financial institutions seeking additional new account and loan volume, this is great news. Video banking not only replaces branch service in a pinch, but it can also extend the reach of your in-person service to capture and service even more profitable relationships. This centralized operational strategy frees your most talented employees from being confined to a specific geographic location. Video banking allows your best employees to make the biggest impact on your organization, leveraging the efficiency and convenience of digital delivery to generate even more high-touch, revenue-generating activities.

For financial institutions seeking additional new account and loan volume, this is great news. Video banking not only replaces branch service in a pinch, but it can also extend the reach of your in-person service to capture and service even more profitable relationships. This centralized operational strategy frees your most talented employees from being confined to a specific geographic location. Video banking allows your best employees to make the biggest impact on your organization, leveraging the efficiency and convenience of digital delivery to generate even more high-touch, revenue-generating activities.

PCSB Bank

PCSB Bank Joy for local children. Sure, we love to achieve career success, but real leaders get even more fulfillment out of using their resources and influence for the greater good. They couldn’t have picked a better year to do this!

Joy for local children. Sure, we love to achieve career success, but real leaders get even more fulfillment out of using their resources and influence for the greater good. They couldn’t have picked a better year to do this!

Remember back before the pandemic, when traditional financial institutions’ greatest concern was relevance? Today with Covid-19 concerns, FI executives are consumed by the need to deliver touchless service while managing new concerns about employee safety, dwindling earnings, loan losses, and capital.

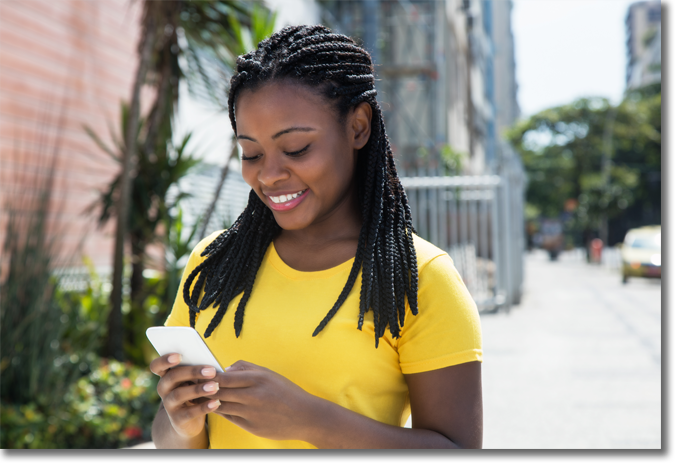

Remember back before the pandemic, when traditional financial institutions’ greatest concern was relevance? Today with Covid-19 concerns, FI executives are consumed by the need to deliver touchless service while managing new concerns about employee safety, dwindling earnings, loan losses, and capital. InRoads LIVE Manager Kim Preston said response to the new video-branching normal has been very well received, even by members who previously rejected digital delivery. She recalled one grandmother and grandson duo who used video banking to open the boy’s first account. The young saver didn’t appear to be thrilled about his first credit union experience until the video representative appeared on the screen. “I can’t believe this, Grandma! Wells Fargo has nothing like this,” the boy exclaimed. And just like that, InRoads Credit Union gained Gen Z relevance.

InRoads LIVE Manager Kim Preston said response to the new video-branching normal has been very well received, even by members who previously rejected digital delivery. She recalled one grandmother and grandson duo who used video banking to open the boy’s first account. The young saver didn’t appear to be thrilled about his first credit union experience until the video representative appeared on the screen. “I can’t believe this, Grandma! Wells Fargo has nothing like this,” the boy exclaimed. And just like that, InRoads Credit Union gained Gen Z relevance.

I’m a big fan of the convenience of digital services, unfortunately, most deployments are targeted to such narrow use cases that it doesn’t address most consumer’s needs. This is especially the case for more complex financial service products. It shouldn’t be that difficult, right? Consumers should just go to the FI’s website, find the products they want and “sign-up”, or in the model of Amazon, add the product to their “online shopping cart”. Yet as branch traffic dwindles and digital adoption grows financial institutions are finding that their “online shopping cart” abandonment rates remain sky-high.

I’m a big fan of the convenience of digital services, unfortunately, most deployments are targeted to such narrow use cases that it doesn’t address most consumer’s needs. This is especially the case for more complex financial service products. It shouldn’t be that difficult, right? Consumers should just go to the FI’s website, find the products they want and “sign-up”, or in the model of Amazon, add the product to their “online shopping cart”. Yet as branch traffic dwindles and digital adoption grows financial institutions are finding that their “online shopping cart” abandonment rates remain sky-high.

Digital service providers are reporting explosive increases in user data over the past two months as shelter-in-place orders have forced consumers to go digital. Attitudes toward digital have seemingly changed overnight – what was once a user experience enhancement is now literally an essential service channel.

Digital service providers are reporting explosive increases in user data over the past two months as shelter-in-place orders have forced consumers to go digital. Attitudes toward digital have seemingly changed overnight – what was once a user experience enhancement is now literally an essential service channel.