SEE WHAT MAKES US

AN ESSENTIAL ASSET

FOR FINANCIAL INSTITUTIONS

ACROSS THE COUNTRY

SEE WHAT MAKES US

AN ESSENTIAL ASSET

FOR FINANCIAL INSTITUTIONS

ACROSS THE COUNTRY

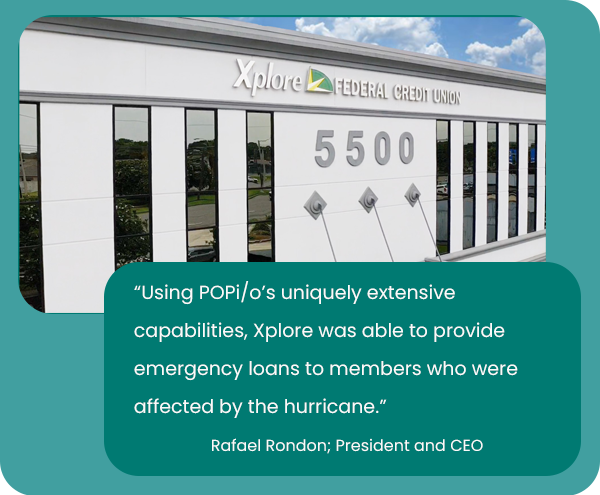

Serving Members in Their Time of Need

At Xplore FCU in Louisiana, POPi/o’s extensive capabilities became vital when Hurricane Ida struck and the credit union had no other way of serving members. Thanks to the unique POPi/o platform, Xplore was still able to serve members in their time of need, and even provide emergency funds for victims of the storm.

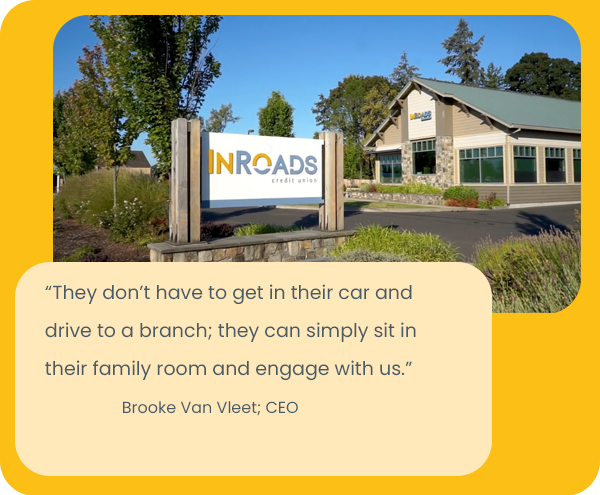

Leveraging Your Strengths

InRoads Credit Union in Oregon rolled out POPi/o in their branches and on their mobile app. With these convenient and user-friendly services, this credit union gave its members a direct path to whatever level of assistance they needed. Anything from simple balance inquiries to more complex banking transactions could be driven through the POPi/o channels, meaning InRoads members’ had a branch with them everywhere they went.

Members Come First

Affinity Plus puts their members first, and with their POPi/o implementation, it shows. This Minnesota-based credit union is providing personalized services to their members through multiple channels. These services have facilitated countless meaningful customer experiences while building brand loyalty.

How to Provide a Complete Digital Experience

Based out of Southern Michigan, this credit union rolled out POPi/o because they wanted to be able to bring their services to their members. By driving loan applications and new memberships through their POPi/o channels, Michigan Legacy ensures their members have the best digital banking experience possible.

WE CAN HELP

Find out why a growing number of financial institutions across the country are implementing our unique Digital Communications platform. With POPi/o, you’ll get the most efficient, user-friendly, and comprehensive digital tools available, creating satisfying customer experiences, and helping you drive revenue-generating services through convenient digital channels.