POPi/o Covid-19 Response

As I write this, the coronavirus death toll in the U.S. has risen to 6,574, and that number is sure to rise by the time you are reading this. Every state in the union has announced positive cases of Covid-19 and most have declared mandatory shelter in place orders. The financial markets have continued to tumble throughout the month of March and the Federal Reserve Board announced its first emergency rate cut since the 2008 financial crisis.

The fatality rate for Covid-19 isn’t as high as other viruses, but what seems to make Covid-19 frightening is how contagious it seems to be. Evidence that Covid-19 is more contagious than estimated lies in the numbers: the virus has reached 210 countries on six continents in a matter of weeks, and many of the infected report no contact with anyone known to be exposed to the virus.

At a time like this, how does a Financial Institution protect their staff and consumers? Most FI’s are choosing to close branches. During the month of March, I talked to hundreds of FI’s. In those meetings, I learned that most branch lobbies remained open on March 16th, but by the end of that week and early into the following week, the majority of branch lobbies had closed or restricted their access.

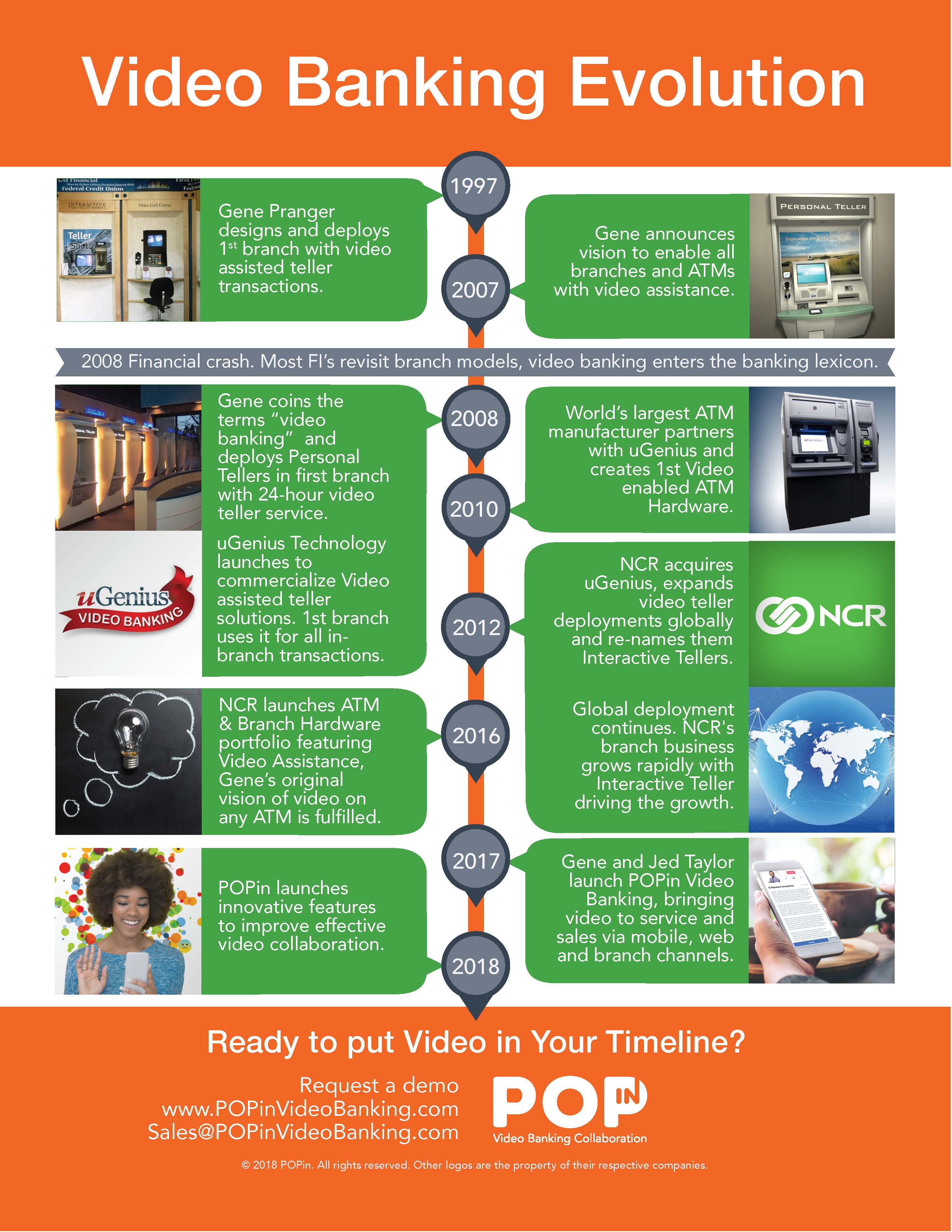

With this restricted access to physical locations, how can FI’s maintain business continuity? Amid the fear, there is some positive news: today’s technology allows financial institutions to provide essential services much easier than during previous pandemics. During the SARS outbreak of 2002, when most financial institutions last updated their business continuity plans, customers utilized call centers, ATMs and online banking services. These days, technology has enabled several additional tools such as mobile banking, mobile check deposit, video teller machines (ITMs), and video banking tools.

This transition to new technologies is happening already. Within 10 days of Covid-19 hitting the U.S. shores, our video banking company, POPi/o, saw video call volume jump 50%. We also saw a rapid shift from our in-branch video call volume to mobile and web video calls. Other financial services providers report digital channel traffic over the last few months to be equal to traffic during all of 2019. We expect traffic to continue growing.

During this pandemic, consumers need access to your FI resources more now than ever. Whether they need to discuss loan modifications or to apply for the government’s payroll protection program, consumer needs are just as high as their anxieties. Video Banking tools can assist financial institutions when they are forced to close branches, or when consumers are unable to leave their homes. FI’s can now deliver teller services from Interactive Teller Machines and with POPi/o Video Banking offer in-depth banking consultations and account services. Today’s Video banking is far more robust than basic communication via phone or video conferencing and allows for new accounts, loan origination, funding new accounts, exchanging documents, signing applications, and any number of account servicing needs.

Before today’s recent events, many of our credit union and bank clients have found POPi/o video banking to be useful in assisting customers who are homebound due to age, illness or disability. Others used it to assist professionals in medical, military or other circumstances that didn’t allow for quick trips to a branch. Now we see personal branch services being delivered to consumers in self-isolation, oftentimes with the staff member safely working from home.

If your credit union or bank is reviewing their business continuity plan and looking for additional ways to provide essential services using digital channels, request a demonstration or give us a call. We’d be glad to discuss how video banking can become an integral part of pandemic mitigation that protects your staff and consumers. Until then, stay safe, and healthy.